Also write "Net Qualified Disaster Loss," your standard deduction amount, and "Standard Deduction Claimed With Qualified Disaster Loss" on the dotted line (don't worry – it's a long line). For 2021 tax returns, enter the amount from Line 15 of Form 4684 on the dotted line next to Line 16 of Schedule A (Form 1040) if you do have a net qualified disaster loss. You need to complete IRS Form 4684 to see if you have a net qualified disaster loss. A qualified disaster loss is a casualty or theft loss of personal-use property that is attributable to:Ī major disaster declared by the President in 2016 Ĭalifornia wildfires in 2017 and January 2018 Ī major disaster declared by the President between January 1, 2018, and February 18, 2020, if the loss occurred before JanuorĪ major disaster declared by the President before February 26, 2021, if the loss occurred between December 28, 2019, and December 27, 2020, and continued no later than Janu(not including losses attributable to a major disaster declared only by reason of COVID-19). If you have a net "qualified disaster loss," you can claim a larger standard deduction. Increased Standard Deduction for Certain Disaster Losses

#2022 vs 2021 tax brackets plus

If you can be claimed as a dependent on another person's tax return, your 2021 standard deduction is limited to the greater of $1,100 or your earned income plus $350 (again, the total can't be more than the basic standard deduction for your filing status).

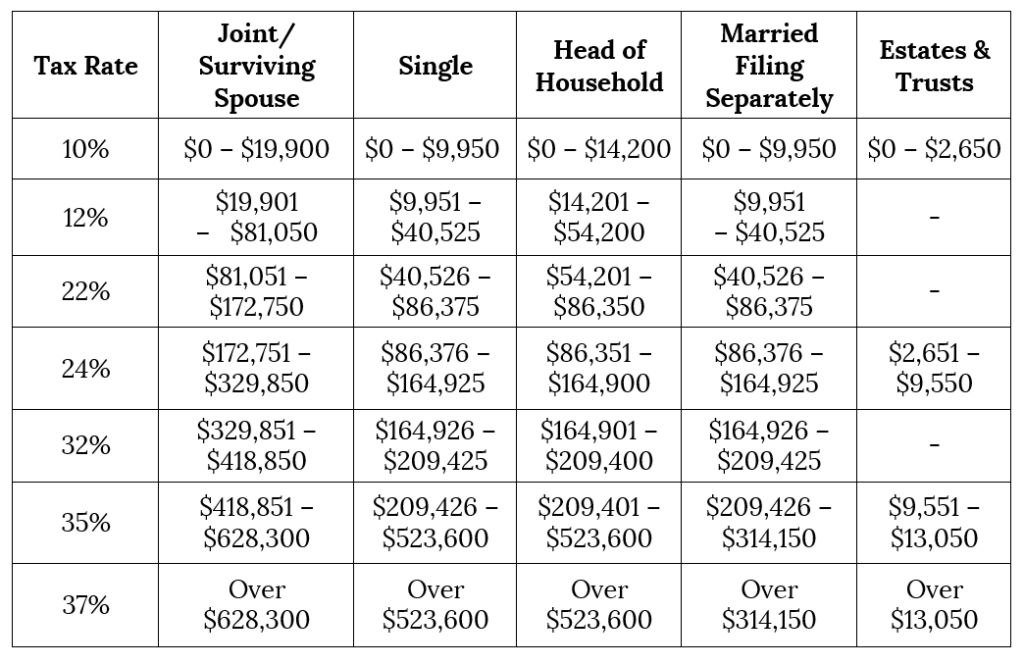

SEE MORE What Are the Income Tax Brackets for 2021 vs. For 2022 tax returns, the standard deduction amounts will be as follows: So how much is the standard deduction worth? It depends on your filing status, whether you're 65 or older and/or blind, and whether another taxpayer can claim you as a dependent on their tax return. You can't claim it if you're a dual-status alien, either. On the other hand, if you're married but filing separate tax returns, you can't take the standard deduction if your spouse itemizes deductions. In addition, if you have a net qualified disaster loss, your standard deduction may be higher (see below). The standard deduction amounts are adjusted annually for inflation, so your 2022 standard deduction will likely be larger than it was for 2021. It's different from year to year and from person to person. But you can't determine which route is better for you unless you know how much your standard deduction is that year. You can't do both, so you want to pick whichever one is higher. You have a choice to make each year when filling out your federal income tax return: Do you claim the standard deduction or itemized deductions. SEE MORE Tax Changes and Key Amounts for the 2022 Tax Year Start with something basic – like the standard deduction. But after taking a short break from taxes to clear your mind, it's a good idea to start thinking about your next federal income tax return now. Unless you requested a tax filing extension, you should be done with your 2021 tax return by now. Picture of the words "tax deduction" written with a fancy pen Getty Images

0 kommentar(er)

0 kommentar(er)