Principal reduction: Buyer and sellers MAY agree that the principal portion (or some portion of a flat rate rent amount) of these rental payments gets applied to the purchase price, thereby reducing what is owed each month.

Land contract payment calculator plus#

A flat rent rate can be chosen, or it can be determined mathematically: The monthly rent payment can be equal to a loan payment for $158k at a higher-than-market interest rate due to the risk, say a bank-loan rate plus 2%, over a normal 30yr period.Ĥ. Term and Rent: Rent for a 3 year term (I’ve see as high as 7 years). Let’s say $158,000 is the outcome and its agreed upon by all.ģ. Say the average rate of inflation is expected to be something like 2% for each of the coming 3 years, then calculate it, agree/negotiate.

So the seller will want to add some appreciation, OR some round number that is agreed upon. Purchase price: Presently, it would be, say, $150k. All depends upon how high the purchase price is, what risks are being taken, etc.)Ģ. (I’ve seen as high as $30,000, with additional annual lump sums reductions of $30k …all in ADDITION to monthly rent – this was for a $500k home.

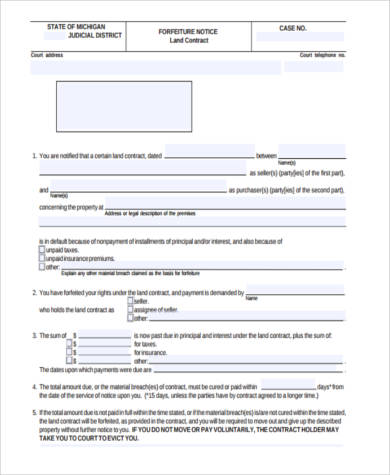

In this case, the seller is a scam artist, luring folks into deposits of cash, with little to no chance of ever changing their financial or credit status…meaning they won’t ever be likely to get a loan and are therefore likely to default.Īll terms are completely negotiable. Then the seller has gotten a good rent over whatever the time period was, AND they get to keep the deposit they got up front. Sellers – A) Have had a hard time selling the property and they don t want to lose the buyer they’ve discovered…even if they are not yet ideal (meaning they cannot currently qualify for a regular loan to buy the property outright.)ī) They are hoping to get as large a downpayment as possible in land contracts, hoping the renter defaults – meaning they go past due on their rent, or they can’t qualify for a loan when the time comes for the contract to expire. Why do folks buy or sell property using land contracts?īuyers – because they cannot qualify for a regular loan at the moment, and they expect that their credit or income situation will improve during the rental period of the land contract, so that later they can get approved for a regular loan and execute the purchase part of the land contract by the time that date arrives. See below for typical components of a land contract. Every deal is different, and so it depends. The property cannot be sold to anyone else without the land contract being satisfied.Ĥ. The land contract IS then recorded at the county clerk’s office to make it official record. They are NOT paid at the expiration/maturity of the land contract, that is, when the buyers payoff the land contract.ģ. A closing IS performed, and real estate professionals are paid, if any are involved. It won’t be signed over until the expiration of the land contract.Ģ. If the buyer defaults on the rent or the land contract’s terms, then the buyer forfeits that deposit to the seller and the land contract is void.ġ. Also, there is a downpayment, which is an good faith deposit. Usually the rent, or a portion thereof, gets applied to the purchase price. All land contracts are different and are customized. A land contract IS an agreement to purchase a property at a future date, at an already agreed-upon price, and to rent it to buyers in the mean time. It is NOT a purchase transaction, it IS an agreement to purchase the property at a future date.

A land contract is nothing more than a rent-to-own agreement.

0 kommentar(er)

0 kommentar(er)