IMPORTANT: What the 1098-T considers a qualified expense is not the same as what your 529 plan considers to be a qualified expense. Those expenses are not counted towards the box 1 total. The IRS does NOT consider room & board, insurance, medical expenses, transportation, or personal living expenses to be qualified education expenses. The 1098-T details how much you paid for qualified education expenses (see box 1). The considerations below can help you answer those questions: Understanding Tuition-related Documents You Receive When Filing Your Taxesīetween January and March, you will receive Tax Form 1098-T from your student’s college. Was any portion of the withdrawal from the student’s 529 plan or other college savings account used for non-qualified expenses?.Is any of the scholarship income considered taxable?.There are two tax questions your CPA (or tax software) will likely ask: Many students and their families are surprised to learn scholarships come with certain tax obligations and may trigger tax consequences.

#1098 T QUALIFIED EDUCATION EXPENSES FREE#

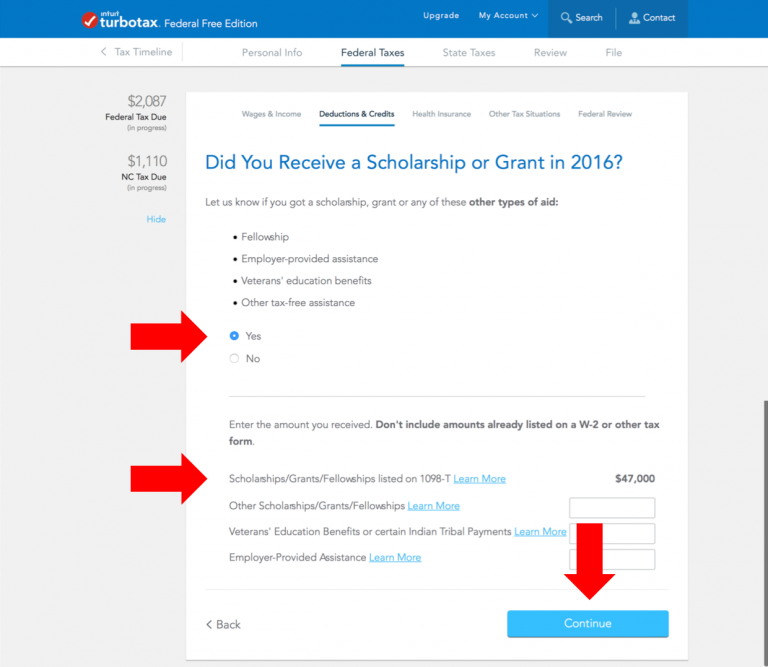

However, a scholarship is NOT always free money. Wherever your child chooses to attend college, a scholarship can reduce or eliminate a student’s or parent’s debt burden. For others, a scholarship can allow your student to attend his or her dream school. The IRS leaves it up to you, the taxpayer, to calculate if and how much of your scholarship is taxable.įor many families, a college scholarship can ensure your child will attend college.Be on the lookout for the two tax forms associated with your student’s education: the 1098-T (from the school) and the 1099-Q (from your 529 savings plan provider.).However, the potential tax implications that come with scholarships are often overlooked. Scholarships can give your child an opportunity to attend a school previously thought to be out of reach.

0 kommentar(er)

0 kommentar(er)